1. Introduction

Welcome to the second in our “Weapons of Mass Disruption” series. In the first article, we considered 5 models of disruption and laid out the reasons why an industry might be disrupted. Now we look at some of the major Disruption Tools and propose a simple framework to develop or identify disruptive business models.

Not wishing to repeat all the findings (you can read it at “Weapons of Mass Disruption”), I would like to mention three key points we made (beyond the models themselves) which are pertinent to this article. They are:

- Disruption is always customer driven - at least to a large extent. If potential customers were satisfied with their existing service it would be hard to disrupt a sector. The customer drivers were mentioned in the previous article.

- Disruption is a process not an event. We don’t just wake up and suddenly find ourselves displaced, even though it may feel like it to some. The signals will have been around for a long time.

- Although technology is a frequent catalyst, it is almost always the business model that evolves because of the technology that is the disruptive force.

The five models described previously were:

- Classic disruptive innovation

- Disruption by 1,000 cuts

- Full stack disruption

- Value chain control

- Industry redefinition

The purpose of this article is to explain what disruption tools are used by disruptors in applying the models above. It is important to note that we are not claiming to have developed some amazing science that can accurately predict disruption and are certain that there will be alternative models and tools to those that we are describing. The objective really is to suggest a useful framework based on empirical observation (and a little theory) that will help an incumbent to defend against being displaced. Or perhaps offer insights to a disruptor as to how they might capitalise on the customer opportunities to radically change the way business is done in a particular sector.

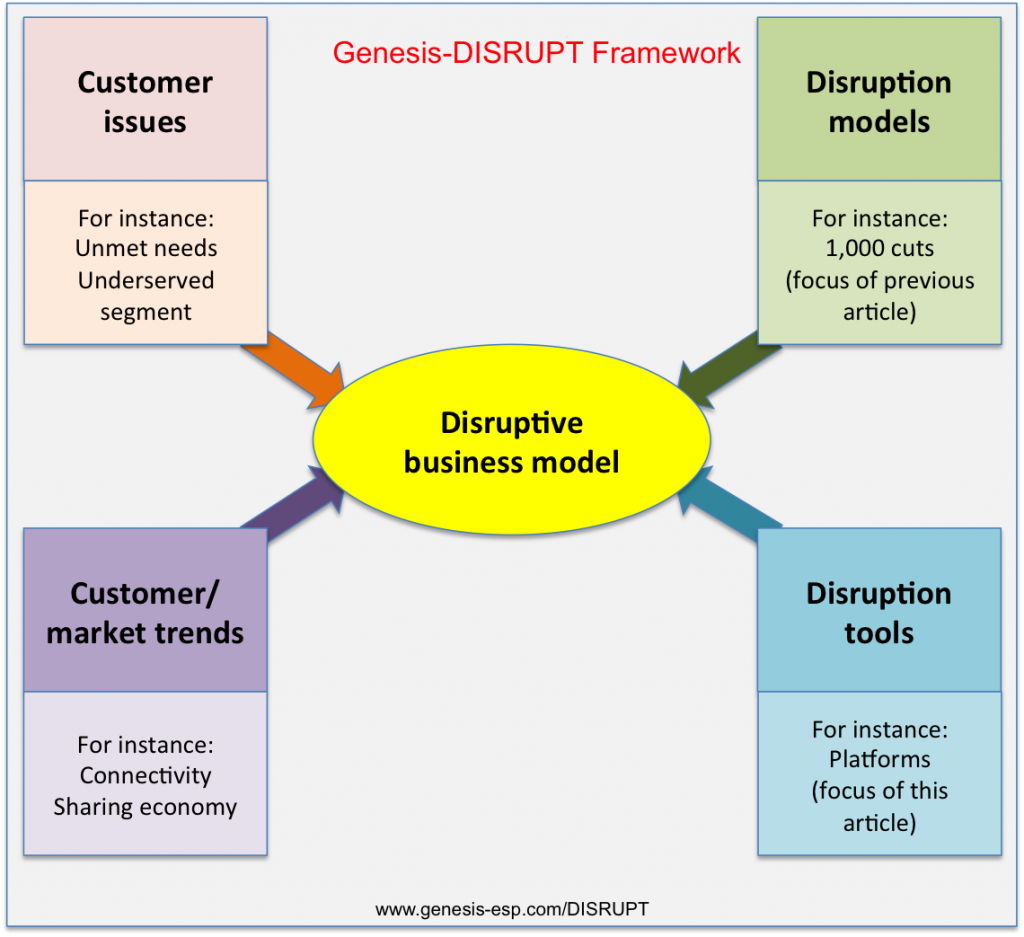

2. The framework

Below is a suggested simple framework for considering how to develop a disruptive business model; or perhaps how to recognise one. It consists of considering each of the four drivers of disruption and fusing them into a business model that fundamentally changes the way in which value is delivered to customers and is substantially better than the way in which current players are operating - and one which they will find it difficult to follow.

In the vast majority of cases, the initial model will only capture a small part of the market share but the critical element is the potential to then scale that model to other segments or product areas.

Want a copy of this framework? Click here to get the image instantly

The process of crafting the desired business model that we use is one that resembles more of an entrepreneurial design sprint, rather than a McKinsey-type analysis. It really requires free-wheeling creativity, the ability to break mental models and toss away long-held assumptions; creation of prototypes and testing with real customers.

As importantly, it should arise from deep inside the customer’s mind-set and the problem she is trying to solve - that is something that comes naturally to an entrepreneur, but is seldom the starting point for an old, established company. If you are interested in finding out more about this process and how we may help, click on the link in the box.

The remainder of this article considers the disruption tools that are frequently used in developing such a business model.

3. Disruption tools

There are a number of tools or plays that are frequently used in changing the way value is delivered. Below we list the main ones we have seen - we do not claim that this is (or could ever be) a finite list, nor that they are mutually exclusive. Frequently it is their combination that actually makes the difference.

Admittedly, we have thrown in a few advanced ideas here that might stretch your mind a little, but when thinking of disruption, it is important to be a little futuristic in our thinking.

Tool 1: platforms

Genesis DISRUPT Disrupt tool 1 platforms

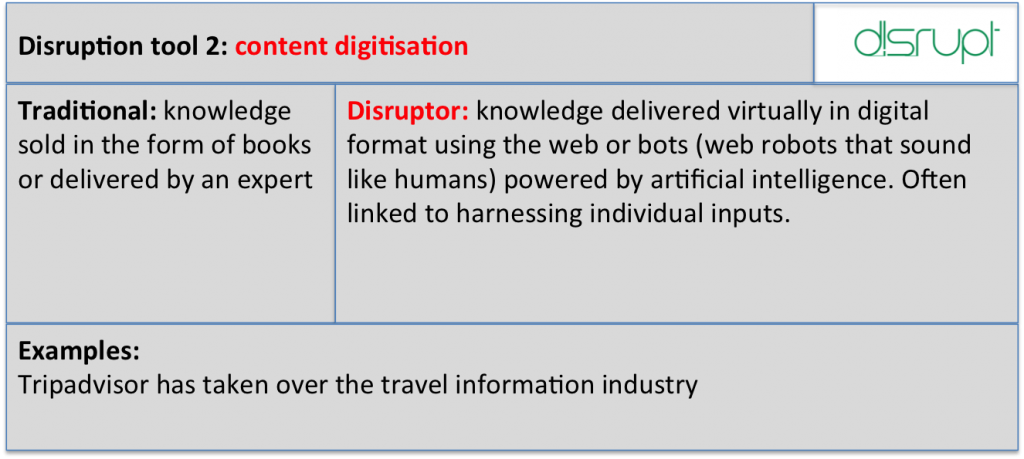

Tool 2: content digitisation

Genesis DISRUPT Disrupt tool 2 digitisation

Tool 3: pricing models

Genesis DISRUPT Disrupt tool 3 Pricing

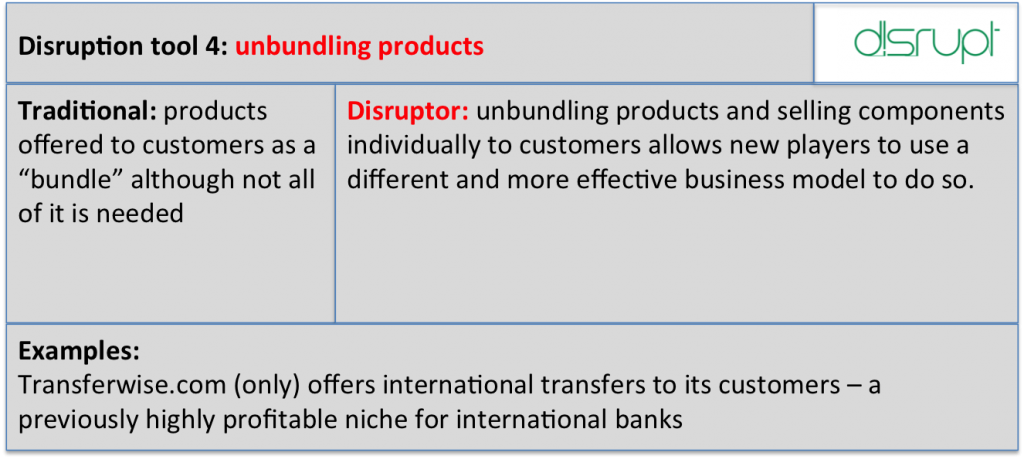

Tool 4: unbundling

Genesis DISRUPT Disrupt tool 4 unbundling

Tool 5: convergence

Genesis DISRUPT Disrupt tool 5 convergence

Tool 6: under-utilised assets

Genesis DISRUPT Disrupt tool 6 under utilised assets

Tool 7: long-tailed distribution

Genesis DISRUPT Disrupt tool 7 long tail

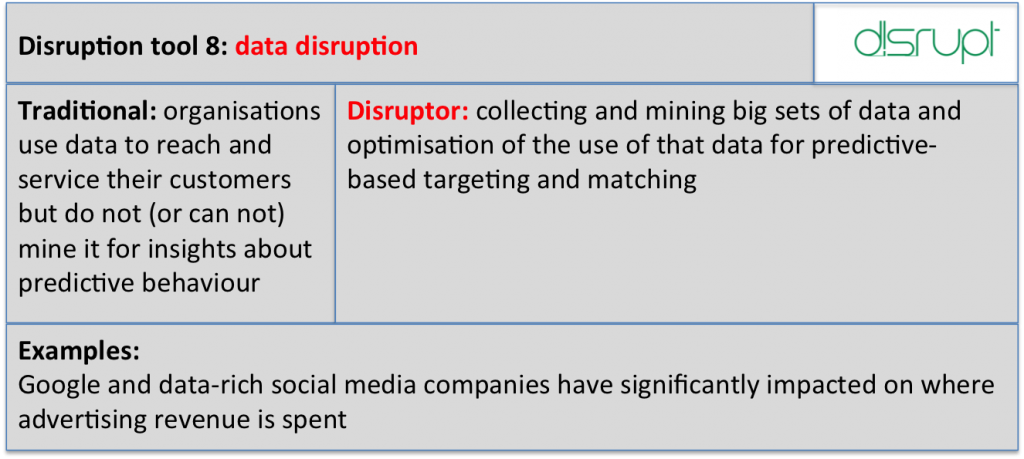

Tool 8: data disruption

Genesis DISRUPT Disrupt tool 8 Data

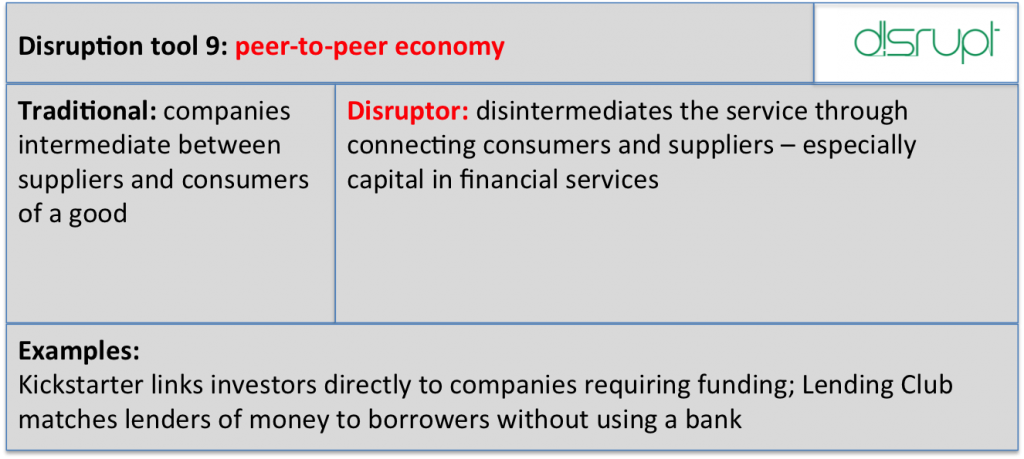

Tool 9: peer to peer

Genesis DISRUPT Disrupt tool 9 peer to peer

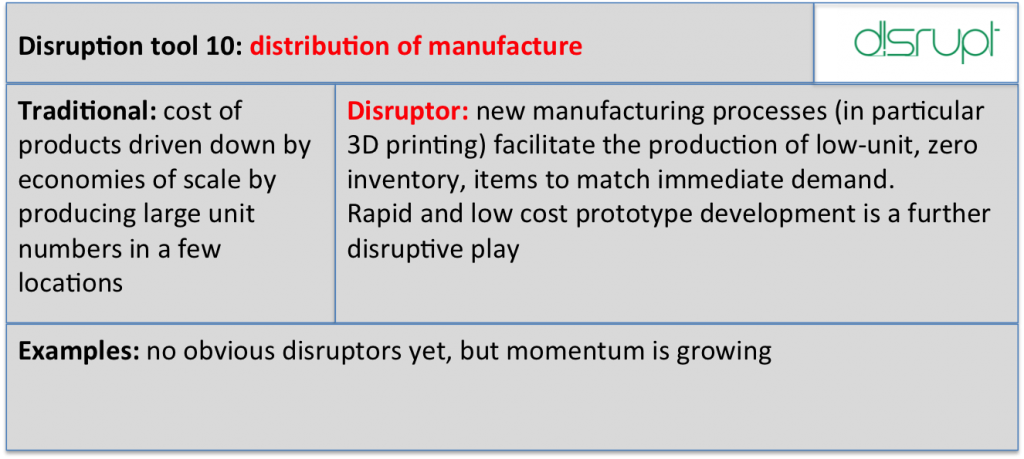

Tool 10: distribution of manufacture

Genesis DISRUPT Disrupt tool 10 manufacture

4. Case study: Insurance

To “test” the framework, we will consider an old and established industry: Insurance. It is a broad industry covering health, life as well as property and casualty. The value chain also stretches from fund management through product development, distribution and claims and administration. There are 46 insurance companies in the Fortune 500 with an average age of 95 years and the total market cap is more than $1trillion - it is an old and established sector.

If we look at examples of each driver, we see plenty of signs of “disreputability”:

- There are many unhappy customers and in fact there is an inherent conflict of interest in that the less claims that are paid out, the more profitable is the company. This makes for a high level of distrust between buyer and seller.

- Here are many customer and market trends impacting on the industry such as the rising cost of health care and trends away from asset ownership being just two.

- The companies are old and steeped in tradition, locked into legacy technology systems and legacy business models (such as a large sales force) and tied up in miles of red tape, legislation and bureaucracy.

- A number of our disruptive models could come into play: servicing under-served markets or inserting oneself at the customer interface inside the value chain using a different model.

- A variety of disruption tools are also available to aggressors such as tapping into the peer to peer economy and mining rich data-sets.

A quick look at what is happening in the industry shows how there are a number of disruptive plays going on. Using CB Insights model, we can see some great examples. Although insurers seem to be taking action (7 accelerators around the world, a slew of acquisitions), still only 18% of insurers said they are prepared for the technological innovations that are going to impact on them in the next 5 years, according to a 2016 study by Accenture.

CB Insights Insurance tech rising

Let us take one example: Guevara. They have invented a new business model based on a peer to peer system where customers start their own insured group and pay insurance into a pool that is used for claims; and a portion to the insurer. The insurer acts as a reinsurer if the pool is depleted through high claims – but if the pool is not emptied the group get refunded the unpaid amount, or it remains in the pool to lower future premiums. Benefits arise through lower claims, less fraud, less churn, lower acquisition costs (members find each other) and better understanding of risk. The business model is very hard for a traditional insurer to copy, at least within the constraints of their existing business. There are certainly questions around the sustainability, the scalability and even the principles of the model – but it is certainly a threat that cannot be simply ignored.

It is tough for insurers (or other companies in industries where potential disruption is taking place) to develop a strategy to survive the onslaught. This is made more challenging by the fact that many of these “dangerous-looking” startups are not likely to survive - but the question is which ones are the ones to look out for.

We will look at some of the possible strategies in our next blog, but in the meantime if you would like to investigate taking action more urgently, why not contact me to talk about our series of DISRUPT workshops that can launch your organisation into the required innovation-thinking that is required.